Anticipation of US Spot Bitcoin ETF Spurs Inflows into Digital-Asset Investment Products

The anticipation of an eventual US spot Bitcoin exchange-traded fund has led to a substantial rise in inflows into digital-asset investment products for a ninth consecutive week. This marks the largest run since the crypto bull market in late 2021, according to data from CoinShares.

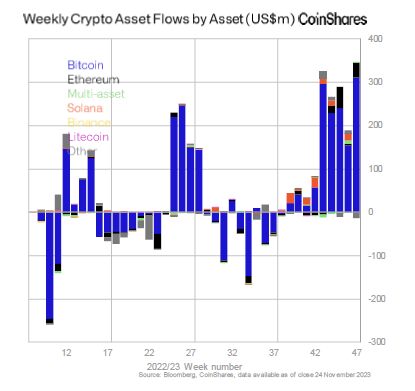

Inflows Last Week

Last week, investment products such as trusts and exchange-traded products saw inflows of $346 million, with Canada and Germany contributing to 87% of the total, while only $30 million came from the US. The low participation from the US is viewed as a sign of continued reluctance in the country to fully embrace digital assets, as noted in a report released by the asset-management firm on Monday.

The Surge in the Crypto Market

Since early October, the crypto market has seen a surge as traditional asset managers like BlackRock have readied themselves for spot Bitcoin ETFs, potentially paving the way for an influx of new investors into the asset. It is important to note that any ETF applications must be approved by the US Securities and Exchange Commission (SEC).

Rise in Total Assets Under Management

“The combination of price rises and inflows have now pushed up total assets under management to $45.3 billion, the highest in over one and half years,” the report said.

Bitcoin and Ether Inflows

Bitcoin products accounted for the majority of inflows, raking in $312 million last week, pushing total inflows to over $1.5 billion since the start of the year. On the other hand, Ether products saw $34 million in inflows last week, which almost negated the outflows seen over the course of 2023.

The Future of Digital-Asset Investment Products

The continuing inflows into digital-asset investment products demonstrate the growing interest and confidence in the potential of cryptocurrencies. With the potential entry of a US spot Bitcoin ETF, the landscape of digital asset investment is expected to undergo a significant transformation, potentially attracting a broader range of investors. However, approval from the US Securities and Exchange Commission remains a critical factor in the future of digital-asset investment products.

Overall, the sustained inflows and the rise in total assets under management signify the increasing role of cryptocurrencies in the wider investment landscape. As global attitudes towards digital assets continue to evolve, the coming months are poised to be crucial in determining the trajectory of digital-asset investment products.