MicroStrategy’s Bitcoin Holdings Propel Stock to New Highs

MicroStrategy (NASDAQ:MSTR), a business firm known for its bullish stance on Bitcoin, saw its shares close above $500 on Black Friday, reaching levels last seen in December 2021. This surge in stock price has driven the company’s market cap to $7.33 billion, as reported by the New York-based tech-heavy exchange.

Holding the Top Cryptocurrency

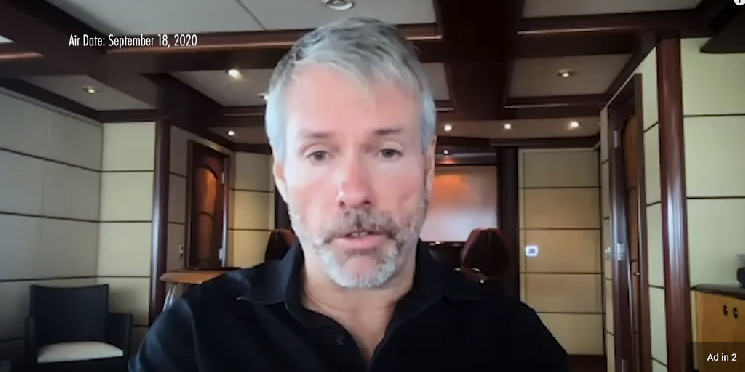

MicroStrategy’s steadfast strategy of holding the leading cryptocurrency has proved to be a winning one. Starting the year with a quarterly loss, the company witnessed its stock price double within a month, indicating the success of its Bitcoin-focused approach. Michael Saylor, the founder and chairman, initiated the company’s Bitcoin acquisition in August 2020 as a hedge against inflation, and this move has paid off significantly.

Bullish Outlook and Strategic Acquisitions

Saylor expressed his bullish outlook during an interview with CNBC, stating, “Demand’s going to increase, supply’s going to contract, and this is fairly unprecedented in the history of Wall Street.” His confidence was further reinforced by the company’s strategic acquisitions. By April, MicroStrategy’s Bitcoin holdings were in the green, with the price of Bitcoin rising above $30,000. The company’s purchase of 1,045 additional Bitcoin increased its total holdings to 140,000, thereby lowering the average purchase price to $29,803 per coin.

Continued Growth and Profitability

Despite reporting a $24 million Bitcoin impairment charge in the second-quarter earnings report, MicroStrategy returned to profitability. As the largest publicly traded company with Bitcoin on its balance sheet, it continued to accumulate BTC, amassing 152,800 coins worth about $4.4 billion. The company’s resilient performance was further reflected in the fact that the stock of companies with Bitcoin exposure outperformed the cryptocurrency itself, which saw an 87% increase in value over the year.

Concurrent with its impressive growth, MicroStrategy persisted in its Bitcoin investments, adding another 6,067 Bitcoin for $167 million in the most recent quarter. This move solidified the company’s position as a major player in the cryptocurrency space, as it now holds approximately 0.75% of Bitcoin’s total circulating supply.

Looking Ahead

MicroStrategy’s unwavering commitment to Bitcoin has not only driven the company’s stock to new heights but has also positioned it as a significant player in the cryptocurrency market. With a bullish outlook and a strong track record of strategic acquisitions and profitability, MicroStrategy is set to continue its ascent in the coming months.