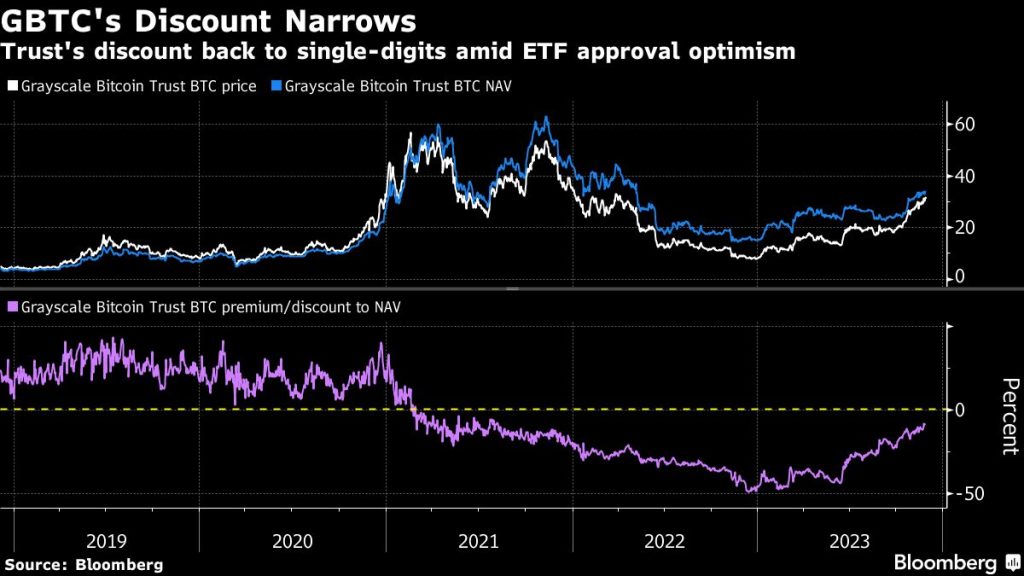

GBTC Discount Narrows as Traders Bet on Bitcoin ETF Approval

Traders are turning increasingly optimistic about the potential for a US spot Bitcoin exchange-traded fund (ETF) approval, as indicated by the tightening discount on the Grayscale Bitcoin Trust (GBTC), the largest crypto fund in the world.

Reduced Discount on GBTC

The $24 billion Grayscale Bitcoin Trust (ticker GBTC) is currently trading at a roughly 8% discount to its underlying Bitcoin holdings, marking the narrowest dislocation in over two years. This significant reduction in discount is a stark contrast to the record discount of nearly 50% GBTC entered 2023 with.

Growing Optimism of ETF Approval

Many market observers attribute the quickly narrowing discount to the growing optimism regarding the potential approval of physically-backed Bitcoin ETFs by the US Securities and Exchange Commission (SEC) after years of denials. The wave of applications from major asset-management companies like BlackRock Inc., combined with the SEC’s loss in court against Grayscale over the agency’s decision to block the bid to convert GBTC into an ETF, have fueled investor hopes for a different outcome this time.

Implications for Investors

Nate Geraci, president of The ETF Store, noted, “It’s reasonable to view GBTC’s discount as essentially a live betting line on spot Bitcoin ETF approval. The remaining discount indicates this isn’t a done deal yet, but there’s clearly optimism in the air.” However, speculation that GBTC will convert into an ETF following the SEC’s blessing has sent billions of dollars into the Grayscale trust, with JPMorgan Chase & Co. analysts warning that those funds are likely to exit quickly after the fact.

Potential Impact on GBTC

Investors who bought into GBTC at the height of its discount have reaped significant profits as the discount has dissolved. While the recent surge has been impressive, it’s unlikely that GBTC will return to trading at a premium to its holdings unless ETF approval becomes a certainty, according to Bloomberg Intelligence analyst James Seyffart.

ETF Analyst, James Seyffart’s Viewpoints

Seyffart stated, “I don’t expect GBTC to head back into a premium before a conversion — though it’s technically possible. We believe that there’s a 90% probability of SEC Bitcoin ETF approval by January 10th but it’s not guaranteed just yet.”

Outflows Warning

Furthermore, JPMorgan analysts caution that outflows could total more than $2.7 billion if Grayscale does not lower its fee following a potential conversion, highlighting the complexities surrounding ETF approval and its potential implications for investors.